By Brad Harris

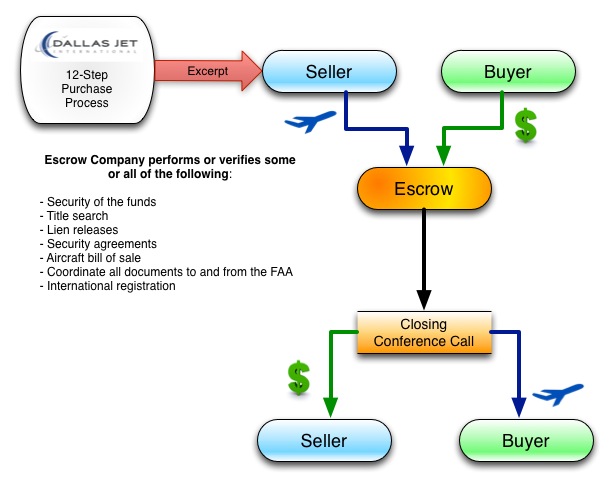

One commonly misunderstood point in the aircraft sale (or purchase) process is the escrow process.

When we are working with a buyer or a seller, we work with a reputable escrow company. Some escrow companies specialize in a particular type of transaction. (Some specialize in international transactions, for example.)

The role of the escrow company is to act as a neutral third party in the transaction.

The following diagram is a simplified overview of the process. Let’s discuss the following chart below of functions the escrow company performs.

Entering into an Escrow Agreement

After the buyer and seller have come to a general agreement and the buyer has submitted a “letter of intent” and the Seller has excepted the LOI, the next step in the process is to “escrow” refundable deposit funds.

The buyer submits the funds required for the transaction, or at least a deposit (as agreed by both parties.) Both parties must also agree on a checklist of items that need to be satisfied for a successful transaction, as well as an agreement of what should happen if any items are not completed successfully. (For example, if an item is discovered in the inspection process that renders the airplane unacceptable to the buyer.)

It is vitally important to have a detailed agreement about the escrow process, (even down to the details of the order in which steps are to occur) so that there are no surprises during the closing.

The Closing Conference Call

Once the inspection process is complete and all documentation has been processed and verified, the airplane is flown to the agreed-on delivery location. We purchase fuel to formally acknowledge the closing location of the transaction.

Then all parties meet via conference call with the escrow representative.

A very specific checklist of events is accomplished during the conference call, culminating in the release of the closing documents to the buyer and the release of the funds to the seller.

As an example, a representative in the Public Documents room at the FAA will call in to report the filing time was for example 2:35PM Central Time.

What Could Possibly Go Wrong?

In one case, we had everything completed, every box was checked, the airplane was “squawk-free” and delivered to Wichita, Kansas for closing, when one item of contention nearly terminated the transaction.

The seller declared that would not release the closing documents until the funds had been received.

Customarily, the documents are released upon receipt and verification of a FED reference number that indicates that a wire has been sent.

The seller did not agree to this – he told his broker to “crank the airplane up and bring it back to Michigan.”

It took several tense phone calls to work out a detailed process to release the FAA Bill of Sale upon receipt of a wire transfer federal reference number by the Seller resulting in the Seller authorizing the escrow agent to file the FAA Bill of Sale and other documents necessary for closing.

Success Factors

- An experienced representative can spot “red flags” early and avoid or prevent expensive, time-consuming problems and errors.

- An Aircraft Broker who is well-known and trusted by many of the parties in the transaction (inspectors, FAA officers, escrow, insurance and legal professionals, as well as other brokers) has the opportunity to suggest creative solutions to resolve any difficulties that arise.

- Detailed agreements outline expectations to everyone’s satisfaction so there are no surprises in the process.

- An experienced escrow professional and a reputable escrow company make the process more comfortable.

At DJI, we take our fiduciary responsibility to represent your interests very seriously. We have long-standing, trusted relationships with escrow companies and legal professionals. We understand how to ensure all requirements are met and there are no surprises for any of the parties in the process.